dallas texas sales tax rate 2020

Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825.

10210 Strait Ln Dallas Tx 75229 Photo View Photos Stairwell Home Values

Real Estate for Sale.

. What is the sales tax rate in Dallas Texas. Download and further analyze current and historic data using the Texas Open Data Center. If you have questions about Local Sales and Use Tax rates or boundary information email TaxallocRevAcctcpatexasgov or call 800-531-5441 ext.

The current total local sales tax rate in Richardson TX is 8250. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. This table shows the total sales tax rates for all cities and towns in Dallas County.

Dallas County is a county located in the US. With local taxes the total sales tax rate is between 6250 and 8250. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent.

There are a total of 981 local tax jurisdictions across the state collecting an average local tax of 1681. 2020 rates included for use while preparing your income tax deduction. The Lancaster Texas sales tax rate of 825 applies to the following two zip codes.

The rates shown are for each jurisdiction and do not represent the total rate in the area. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Cedar Hill is in the following zip codes.

The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. You can print a 825 sales tax table here. Dallas Co 2057217.

Local Sales Tax Rate Information Report. There are approximately 28709 people living in the Lancaster area. Terminate or Reinstate a Business.

Map tax nearby homes for sale home values school info. 214 653-7888 Se Habla Español. 104 rows Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone.

View all homes on Caruth Blvd. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. For tax rates in other cities see Texas sales taxes by city and county.

An alternative sales tax rate of 825 applies in the tax region Dallas which appertains to zip code 75134. The Texas sales tax rate is currently. The December 2020 total local sales tax rate was also 8250.

The Dallas sales tax rate is. The sales tax rate in Dallas is 825 percent of taxable goods or services sold within c ity limits. Dallas County Coronavirus COVID-19 Information.

Check out the new. Wayfair Inc affect Texas. Texas has recent rate changes Thu Jul 01 2021.

The Re-Sales Program team is here to assist you and to answer any questions you may have about the Program. This is the total of state county and city sales tax rates. Tax Office Past Tax Rates.

Average Sales Tax With Local. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes. Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2.

If you do business in any of these unique city areas you must use the combined area local code instead of the regular city and countyspecial purpose district codes to report local sales and use tax. The state sales tax rate in Texas is 6250. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825. 214 653-7811 Fax. Did South Dakota v.

Sales Tax Permit Application. View photos map tax nearby homes for sale home values school info. 2022 Tax Rates Estimated 2021 Tax Rates.

Sales Tax Breakdown Cedar Hill Details Cedar Hill TX is in Dallas County. Select the Texas city from the list of popular cities below to see its current sales tax rate. 214 653-7888 Se Habla Español.

Texas Comptroller of Public Accounts. 75134 and 75146. The December 2020 total local sales tax rate was also 6250.

As of the 2010 census the population was 2368139. The minimum combined 2022 sales tax rate for Dallas Texas is. Texas has 2176 special sales tax jurisdictions with local.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. This rate includes any state county city and local sales taxes. Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone.

Taxes Home Texas Taxes. City sales and use tax codes and rates. 4024 Caruth Blvd is a property in Dallas TX 75225.

214 653-7811 Fax. The tax is collected by the retailer at the point of sale and forwarded to the Texas Comptroller on a monthly or quarterly basis. Contact each city directly for property zoning information and lien releases for tax foreclosed properties.

Richardson TX Sales Tax Rate. The County sales tax rate is. There is no applicable county tax.

Suite 3300 Dallas TX 75202 Telephone. Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas County TX is 6250. The December 2020 total local sales tax rate was also 8250.

Historical Sales Tax Rates for Dallas 2022 2021 2020 2019 2018 2017 2016 2015.

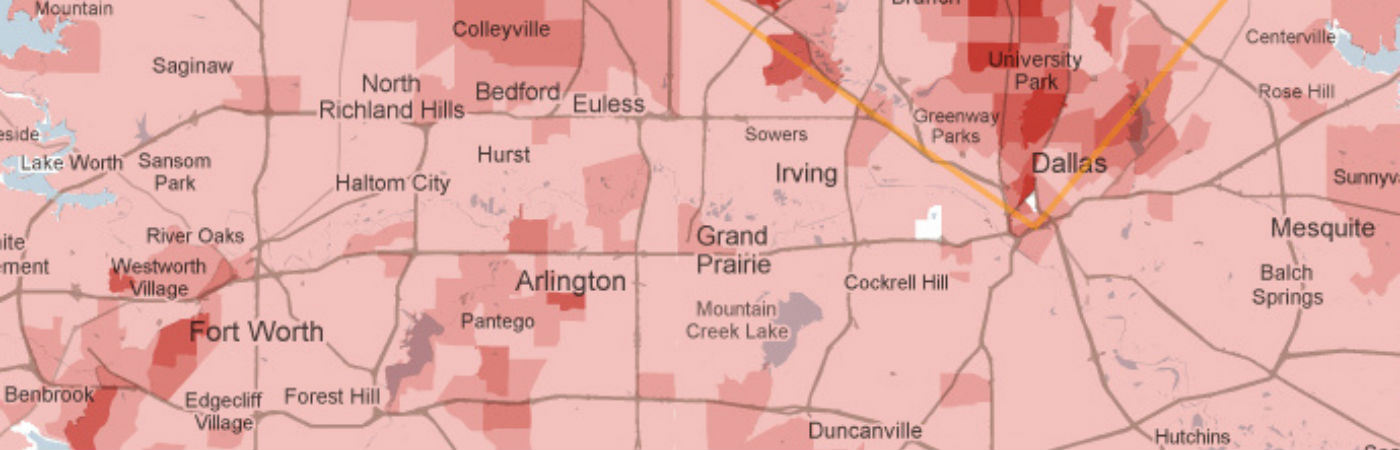

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Mattress Sets Clearance Prices Mattress Sale Cheap Mattress Sets Dallas Mattress Sales Cheap Mattress Sets Mattress Sets

Tax Information City Of Sachse Official Website

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Tax Deductions When Selling A Home Selling House Tax Deductions Selling Your House

Comparing Lowest Property Taxes Of Dallas Fort Worth Homes Can Be Confusing Misleading

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

2021 2022 Tax Information Euless Tx

Texas Sales Tax Small Business Guide Truic

Texas Sales Tax Rates By City County 2022

Tax Rates Richardson Economic Development Partnership

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Which Texas Mega City Has Adopted The Highest Property Tax Rate